Employees' Provident Fund Organisation (EPFO) Queries

You are working in a company, and you have witnessed that every month, a part of your salary is deducted under the label of Provident Fund (PF).

Doesn't a question come to your mind whether your hard-earned money is going to the PPF section or not? Well, we are here for you.

In this blog, we will teach you how to look for your money (deducted salary) as savings in a Provident Fund (PF).

How to Activate UAN (Universal Account Number) for EPFO (Employees’

Provident Fund Organization)?

Before activating the UAN number, let's discuss what it is? UAN number is a number allotted to the employee working for an organization; through that number, his/her provident fund is deducted by the employer from the salary.

Quick Fact: You can see the UAN number on your monthly salary slip.

Now, back to question: how to activate your UAN

number? Below is a step-by-step guide of activating your UAN number.

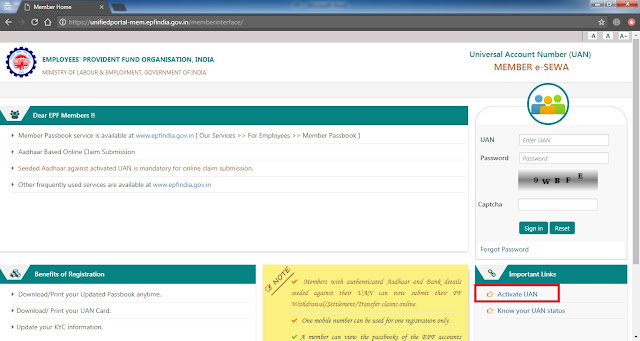

1) Click on Activate UAN. Below is the screenshot

attached for the reference.

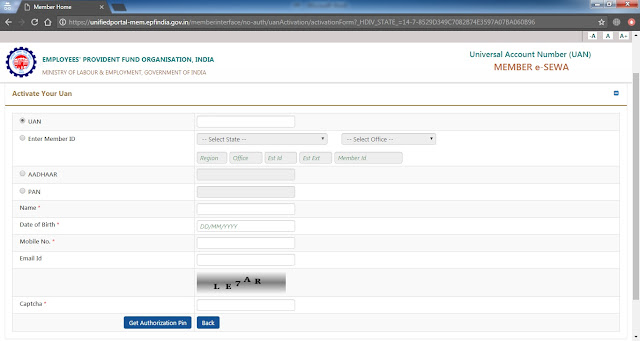

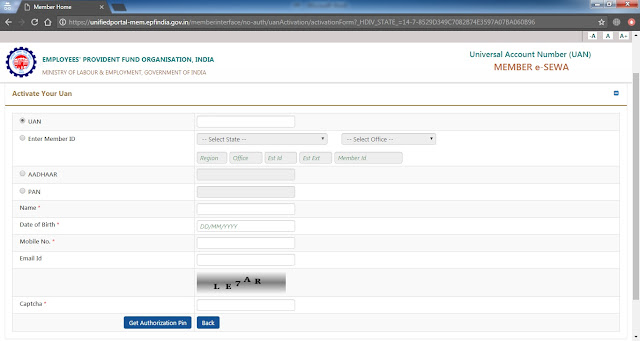

2) After clicking on Activate UAN, it will take you to

a new link, which is shown in the below screenshot.

|

| EPFO's UAN Activation Portal |

3) After clicking on Activate UAN, it will take you to

a new link, which is shown in the below screenshot.

|

| EPFO's UAN Activation Form |

4) Fill out the form, as per your details, and in the

last, press on Get Authorization Pin.

After the above steps, you will get a message on

your registered mobile number, of the confirmation.

How to know the status of UAN number for EPFO?

The easiest steps to know the status of your UAN for

EPFO, whether the UAN is activated or not, is as below:-

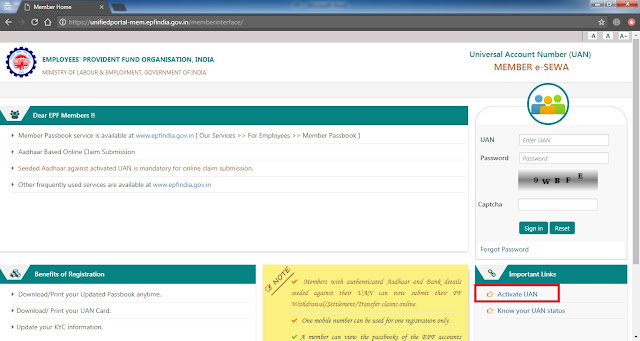

2) Click on Know Your UAN Status. Below is the

screenshot attached for the reference.

3) Fill out the form, as per your details, and in the

last, press on Get Authorization Pin.

How to check your EPFO Member Passbook?

You should know that the amount which is deducting

your salary every month is going in your EPFO or not.

Just follow these simple steps:-

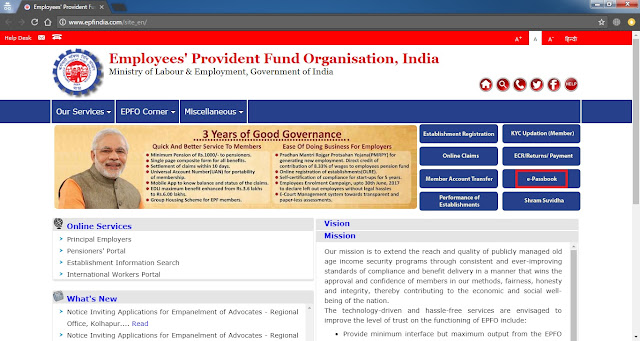

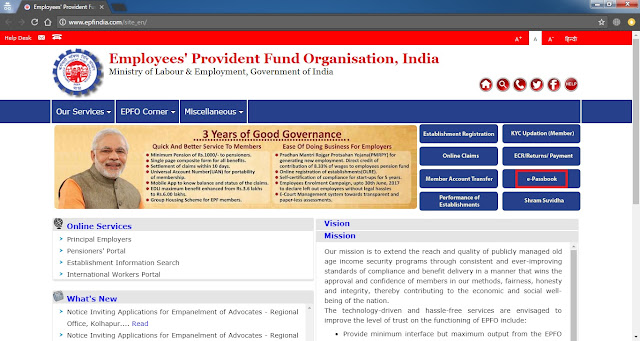

1) Go to the official government website of EPFO

(Employees’ Provident Fund Organization) - www.epfindia.com

2) Click on e-Passbook. Below is the screenshot

attached for the reference.

|

| EPFO's Website |

3) A new link

(https://passbook.epfindia.gov.in/MemberPassBook/Login.jsp) will be opened,

when you click on the e-Passbook. Below is the screenshot attached for the

reference.

|

| EPFO Member Passbook Login |

4) Fill out your details in the form. In the first row,

UAN (Universal Account Number) number will be filled, which you can get from

your salary slip. In the second row, fill the password of your member portal.

Below is the screenshot attached for the reference.

There is an alternative

to the above steps is given below:-

2) Click on Member Passbook, under SERVICES. Below is the screenshot attached for the

reference.

|

| EPFO's Website |

3) A new link

(https://passbook.epfindia.gov.in/MemberPassBook/Login.jsp) will be opened,

when you click on the e-Passbook. Below is the screenshot attached for the

reference.

4) Fill out your details in the form. In the first row,

UAN (Universal Account Number) number will be filled, which you can get from

your salary slip. In the second row, fill the password of your member portal.

Below is the screenshot attached for the reference.

The third alternative is that, just click on the

below link, and you will reach the Provident Fund’s E-Passbook:

How to know your Provident Fund instantly on Mobile?

If you want to know your Provident Fund’s balance

instantly on your mobile, then give a call to the below number:

011-22901406

When you give a call to the above number, your call

will be automatically cut by the system, and you will get an instant message on

your mobile of the Provident Fund (PF) balance, available at that time, in your EPFO

member passbook.

Useful Terms related to Provident Fund:

- UAN: Universal Account Number

- PF: Provident Fund

- EPFO:

Employees’ Provident Fund Organization

We have tried to solve all of your

queries related to EPFO. If there is anything left, you can share your queries

in the comment section, and we will try to solve it. Thanks for reading the

blog. If you like it, please tell others also about this. J

No comments:

Post a Comment