Income Certificate in Delhi: Delhi Government offers Income Certificate to the Delhi residents issued by the Revenue Department, Government of NCT Of Delhi. You can apply for an income certificate in Delhi region if your income is less than a prescribed amount and you want to avail of concession in several services.

Steps to Apply for Income Certificate in Delhi

The applicant can apply for Income Certificate in Delhi by

two methods:

- Online Method for Income Certificate

- Offline Method for Income Certificate

We will discuss both methods as below:

Online Method for Delhi Income Certificate

You have to visit the official e-District Delhi website: https://edistrict.delhigovt.nic.in/

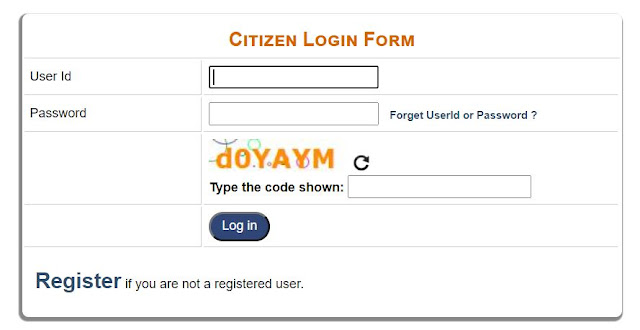

1. Log into your account with User ID & Password. If you don’t have an e-District Delhi account, then you have to generate an account on it. When you select Registered User Login, then you will be asked to enter your credentials.

|

| E-District Delhi Login for Delhi Income Certificate |

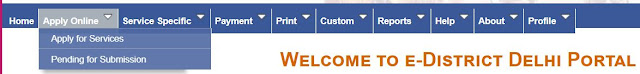

2. Hover your mouse cursor to “Apply Online” and then click on the “Apply for Services” option.

|

| Apply for Services in E-District Delhi Portal |

3. You will be redirected to a new page and there you have to scroll down (go to Serial number 10) for the “Issuance of Income Certificate” option and click “Apply”.

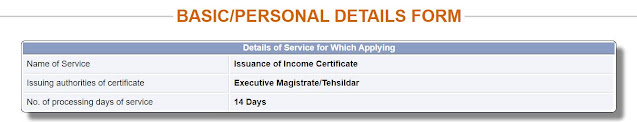

| 14 Days Required for Issuance of Delhi Income Certificate |

4. On the next page, you can see the basic details that you can

edit and click Continue.

|

| E-District Delhi Portal for Delhi Income Certificate |

5. Now, you have to fill in the entry form for Delhi Income Certificate.

How to Fill Online Delhi Income Certificate?

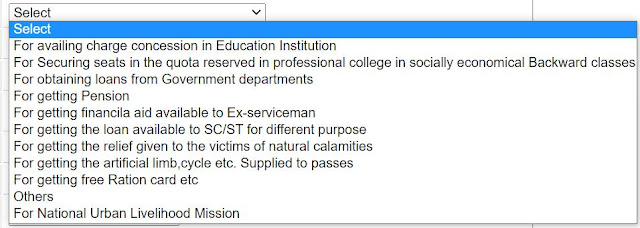

1. Purpose to obtain Certificate: In first column, you have to state your purpose for which work you are applying for it.

|

| Select your Purpose for Delhi Income Certificate |

2. Place of Residence: If you live in your house then select the “Owned” option. However, if you live in a rented place, then select the “Rent” option.

3. Whether Income Certificate Issued Earlier? You can

click on the “Yes” option if you have earlier applied for Delhi Income

Certificate, and you have to fill in the prior income certificate number.

Otherwise, select the “No” option.

4. Do You Have an Electricity Connection in Your Name? Click

“Yes” if the electricity connection is in your name, but if the connection is in

somebody else’s name, then select the “No” option.

5. Are You NFS/BPL Ration Card Holder? You have to click

“Yes” if you hold a below poverty line (BPL) card with you; otherwise, state

your answer as “No”.

6. Are You Income TAX Payee? If you submit your income

tax every year, then you can select “Yes”; otherwise, click on the “No” option.

7. Amount of School Fees for Paid for Your Children Per

Month? Fill in the amount you as prescribed on your child’s school fees.

8. Family Annually Income from all Sources: In this box,

you have to fill in the amount of family income that is earned every year. You

have to state the combined income of your family member if you have a brother,

sister, and father, etc. is working in the form.

8.1. Monthly Income of other family members of your family: Fill

in the family member’s name, relation with you, and the income earned by them

in this category.

After all of this, you have to click “Continue” and your

application for Delhi Income Certificate will be sent to the Delhi Government Revenue

Department.

Offline Method for Delhi Income Certificate

You can download and print the income certificate form from https://cdn.s3waas.gov.in/s388ae6372cfdc5df69a976e893f4d554b/uploads/2018/07/2018071280.pdf

for the offline method.

How to Fill Offline Delhi Income Certificate?

Now, discussing the offline method for Delhi Income Certificate.

1. e-District Registration Number: Fill in your e-District Registration number.

2. UID (AADHAAR) Number: If you don’t have an e-District Registration number, then you can provide your Aadhar Card number for the offline Delhi Income certificate.

|

| Offline Form for Delhi Income Certificate |

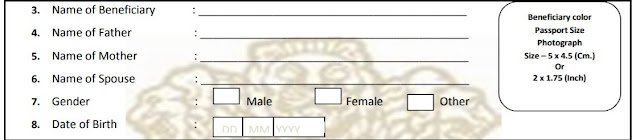

Name of Beneficiary: The applicant has to mention its

name here, or it can mention the name of the person who is applying for the

Delhi Income Certificate.

Name of Father: Mention your father’s name in this

section for Delhi Income Certificate.

Name of Mother: You have to mention your mother’s

name in this category for Delhi Income Certificate.

Name of Spouse: You can mention your husband or

wife’s name in this section.

Gender: You have to mention your gender in this

section.

Date of Birth: In this box, you have to fill in your

correct date of birth.

|

| Basic Details required in Delhi Income Certificate |

Mobile No.: Provide your 10-digit mobile number so

that you can regular updates on it about Delhi Income Certificate.

E-mail: You can provide your e-mail ID to the revenue department so that you can regular updates on it about Delhi Income Certificate.

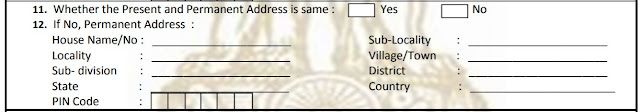

Present Address: In this section, you have to provide your address where you are currently residing.

|

| Fill your Present Address for Delhi Income Certificate |

Permanent Address: Fill in your home address the same as printed on your official government ID, like, Aadhar Card, Voter ID Card, or passport, etc.

|

| Permanent Address section for Offline Income Certificate |

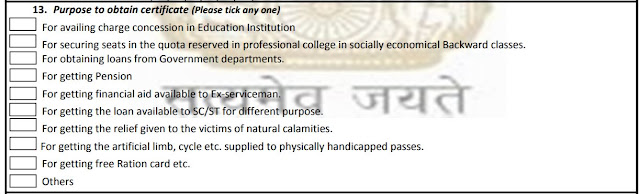

Purpose to obtain a certificate (Please tick anyone): You can describe your objective to acquire the Delhi income certificate: -

- For availing charge concession in Education Institution

- For securing seats in the quota reserved in professional college in socially economical Backward classes.

- For obtaining loans from Government departments.

- For getting Pension

- For getting financial aid available to Ex-serviceman.

- For getting the loan available to SC/ST for a different purpose.

- For getting the relief given to the victims of natural calamities.

- For getting the artificial limb, cycle, etc. supplied to physically handicapped passes.

- For getting free Ration card etc.

- Others

|

| Select your Purpose for Delhi Income Certificate |

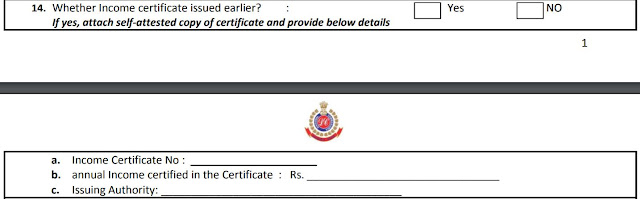

Whether Income certificate issued earlier? You can click “Yes” if you have a prior Delhi income certificate. If your option is Yes, then you have to fill in old income certificate details, such as Income Certificate Number, Annual Income certified in the Certificate, and Issuing Authority. For the issuing authority, you can mention the Revenue Department of the Delhi Government. Furthermore, if you have the income certificate that is issued by the Central Government, then you can write its name on the form.

|

| Upload your Last Income Certificate Number |

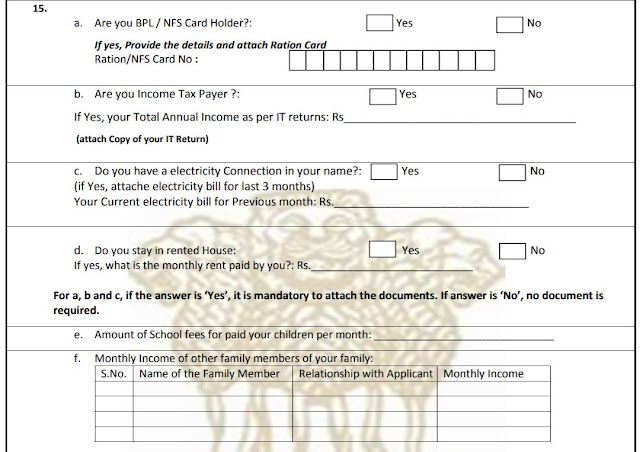

Are you BPL / NFS Card Holder? Click Yes if you have BPL or NFS card, and fill in the BPL/NPS number on the income certificate form along with a photocopy of the ration card; otherwise, mark your answer as No.

Are you Income Taxpayer? You can mark your answer as Yes if you fill the income tax return (ITR) annually and write your annual earnings in the form as same stated in your ITR. Otherwise, you can mark “No” in the form.

Do you have an electricity Connection in your name? Whether

you mark “Yes” or “No” for this option, you have to attach your prior three

months electricity bill. The electricity connection should be in your name if

you tick the “Yes” option, and if you tick the “No” option, then it can be in

somebody else’s name.

Do you stay in a Rented House? Fill in the answer as

“Yes” if you don’t own the place. Then, you have to attach the rent receipts

with it. If you mark the “No” option, then no documents are required.

Amount of School fees paid for your children per month: Fill

in the number of fees you pay to the school for your child.

Monthly Income of other family members of your family: If

you have earning members in your family, then you have to write their names,

occupation, and salaries in the form.

|

| Details about Family Income |

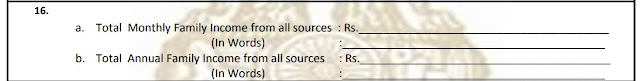

Total Monthly Family Income from all sources: In this slot, you have to mention the cumulative income amount of your family earned from other sources, for example, agriculture or any other work. Mention the amount in words and numeric forms.

|

| Mention your Total Family Income for Income Certificate |

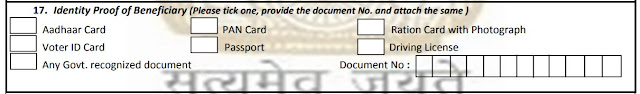

Identity Proof of Beneficiary (Please tick one, provide

the document No. and attach the same): You can provide a photocopy of any

government document consisting of the Aadhaar Card, Voter ID Card, PAN Card, Passport,

Ration Card with Photograph, or Driving License. However, you also have to

mention the document number in the “Document No.” box.

|

| State your Identity Proof for Delhi Income Certificate |

Present Address Proof of Beneficiary (Please tick one,

provide the document No. and attach the same): You have to provide your

details where you are currently residing. Therefore, you can attach a

photocopy of the AADHAR Card, Water Bill (Utility Name), Telephone Bill

(Company name), Rent Agreement (Registered), Bank Passbook, Voter ID Card, Ration

Card, Driving License, Electricity Bill (DISCOM Name), Gas Bill (Company Name),

or any government recognized document. Make sure that whichever documents you

provide, then you have to mention “Document No.” with it.

|

| Present Address required for the Income Certificate |

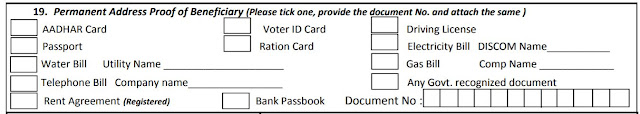

Permanent Address Proof of Beneficiary (Please tick one,

provide the document No. and attach the same): This is the same as the

above section. In this section, you can give any of the above-stated documents

for the Delhi Income Certificate.

|

| Permanent Address for the Income Certificate |

In the last step, you have to sign the form with the date and place.

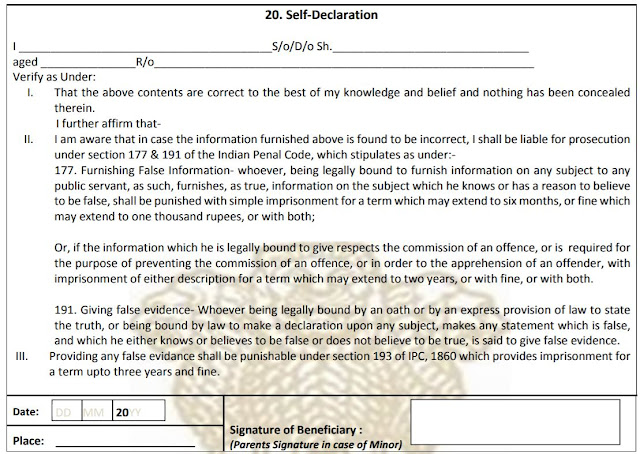

Self-Declaration: Self-Declaration in Income certificate means that whichever information you have filled in the income certificate form is correct. If it is incorrect, then you are eligible for a fine, or imprisonment or both. Fill in your details and sign it, and you can submit it to the SDM office near your area.

|

| Delhi Income Certificate Self Declaration Form |

A quick tip: If you want to apply for the Delhi Income

Certificate in the offline method and don’t know about the Delhi SDM office,

then you can go to Google and type: income certificate near me. Google will tell you the results

for the nearest SDM office.

Frequently Asked Questions on Delhi Income Certificate

Question 1: Can I get an income certificate in one day?

Answer 1: No, you cannot get an income certificate in one

day. There is a timeframe of 14 days.

Question 2: How can I verify my Delhi Income Certificate?

Answer 2: You can verify your Delhi Income Certificate by

the online method. Visit the e-District link and you can verify it from there.

Question 3: What is an income certificate affidavit?

Answer 3: An income certificate affidavit is a formal

document duly stamped and signed by you. In this document, you state your name,

home address, purpose of applying for income certificate, and income, etc.

Where to apply income certificate for Delhi?

Answer 4: You can apply income certificate by 2 methods:

Online or Offline Method. Read our blog for these methods.

Question 5: Where to download the income certificate?

Answer 5: You can download the income certificate from

e-District Delhi website of the Delhi Government.

Question 6: Who issue income certificate in Delhi?

Answer 6: The Delhi income certificate is issued by the

Revenue Department of Delhi Government.

Question 7: Why income certificate was rejected?

Answer 7: Your income certificate can be rejected for

several reasons. You haven’t filled the full information; the information you

provided is incorrect; or any other reason.

Question 8: What is the validity of Delhi Income

Certificate?